- Crypto Sum

- Posts

- The Future of Data: Pyth Network

The Future of Data: Pyth Network

How Pyth Network Is Becoming The Bloomberg Terminal of Web3.

Good Afternoon,

Hope everyone is having a great weekend!

Today we will dive deep into the business of data and core belief that the future of finance depends on trusting data you can verify, not just buy.

In this article, we will cover:

How and Why market data is broken

The Bloomberg Terminal of Web3: Pyth Pro

How Pyth is reinventing market data

Why it matters to Wall Street & DeFi alike

Before we dive in, huge shoutout to Pyth Network for sponsoring this deep dive - make sure to check them out.

Happy Monday, let’s dive in.

Pyth Network Is Reinventing Market Data

Markets may be closed, but the flow of information never stops.

The future of finance depends on trusting data you can verify, not just buy.

Pyth is positioning itself as a contender to displace, or at least radically disrupt, the incumbents of market data, while serving both blockchain-native protocols and traditional institutions alike.

Some are even calling it the Bloomberg Terminal of Web3.

Recently, the U.S. Department of Commerce selected Pyth Network to bring official U.S. economic data, like GDP, on-chain (much more on that later)

So pour your coffee and buckle in. Let’s unpack how Pyth works, why it matters, and what to watch next.

🚨 The Problem: Market Data Is Broken

Every serious trader lives and dies by the feed. But for all its sophistication, the market-data industry in many ways still feels stuck in the 1990s

Oligopolies own the pipes: Bloomberg, Refinitiv, ICE, and a handful of exchanges sell data bundles with paywalls and NDAs that read like state secrets.

Cost Gouging: Market data fees have increased by 30–60% (net of inflation) from 2008–2018 (10-year period), and this trend accelerated between 2017–2024.

Latency kills: In volatile markets, milliseconds matter and a lagged quote can trigger false liquidations or missed arbitrage

Fragmentation everywhere: Crypto traders stare at 50 exchange APIs; equity desks juggle 12 data vendors. None talk natively to blockchains

Opaque sourcing: Most oracles today scrape or aggregate third-party feeds. Users have no idea where prices truly originate.

The result: investors fly blind in the one place transparency should thrive: on-chain markets. “If you can’t trust the data, you can’t trust the trade.”

That’s the itch Pyth aims to scratch.

The Tailwind: On-Chain Finance Meets Institutional Demand

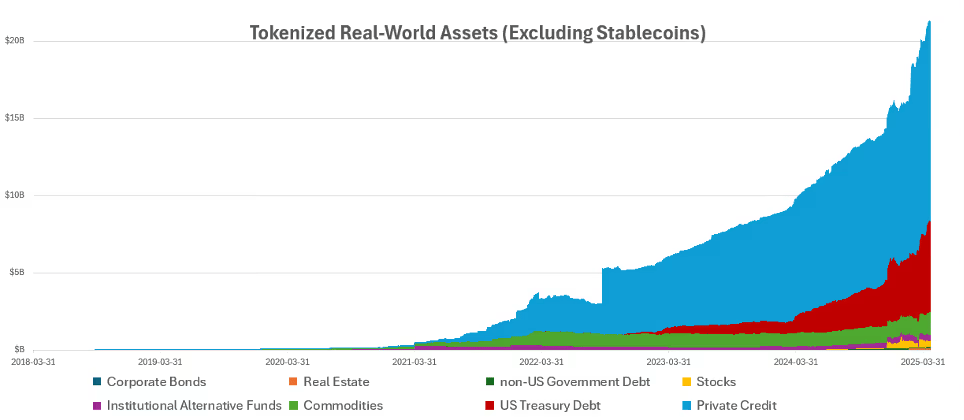

DeFi protocols now settle billions daily. Real-world assets (from U.S. Treasuries to carbon credits) are being tokenized. Yet the data powering these instruments still runs through legacy APIs built for 20-year-old systems.

At the same time, Wall Street’s data bill keeps climbing:

Analysts peg the global market-data spend at $50 BILLION a year. Even a 1% slice is a half-billion-dollar business.

Institutions want faster, cheaper, and auditable data that plugs into both their risk engines and smart contracts.

The timing couldn’t be better to modernize the data infrastructure. DeFi developers want feeds they can trust without running their own infrastructure.

Both camps are converging and Pyth sits right at that intersection.

🌐 What Exactly Is Pyth Network?

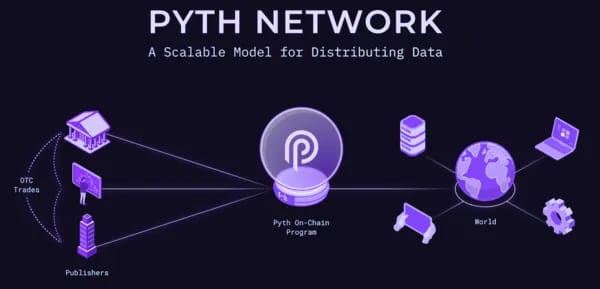

At its core, Pyth Network is a decentralized data oracle designed to deliver high-frequency, first-party financial data to blockchains.

Instead of scraping APIs, Pyth invites the actual owners of data such as exchanges, trading firms, market makers to publish prices directly.

On top of this, the owners of data are actually financially incentivized to provide accurate and fast data.

Over 100 institutions push real-time quotes for assets across crypto, equities, FX, and commodities every single day

The Next Phase: Pyth Pro

2021–2024: Pyth focused on adoption, integrating with major blockchains and powering thousands of DeFi apps.

In 2025, Pyth launched Pyth Pro, a paid data service offering institutional-grade market feeds across assets with transparent pricing, API/on-chain delivery, and revenue sharing for publishers.

🔮 Pyth Pro Explained:

Pyth Pro is Pyth Network’s paid subscription offering real-time market prices straight from top exchanges, banks, and trading firms.

Instead of relying on third-party aggregators, Pyth sources data directly from those who set the markets, then transparently aggregates and delivers it to institutional systems and on-chain workflows.

It provides faster, more reliable access to global market data through one subscription. This cuts out middlemen, simplifying licensing, and expanding coverage across asset classes.

First-party data: closer to price discovery

Transparent: contributors and aggregation visible on-network

Unified Global Coverage: all venues, regions, and asset classes — one network.

Transparent, Tiered Pricing: Predictable pricing replaces opaque contract with flat rates and no hidden exchange fees or markups

One API, one contract for all data

📌 In short: Pyth Pro gives institutions first-party, global, transparent data faster, fairer, and closer to real price discovery than legacy vendors.

Want to find out everything that Pyth Pro offers?

Why It Matters to Wall Street & DeFi Alike

🏗️ For DeFi Builders: Pyth transforms how protocols handle risk.

Liquidations fire off real prices, not stale data.

Derivatives settle on institutional-grade quotes.

Structured-product vaults can reference equities or FX with millisecond precision.

🏦 For Institutions: Pyth offers a compliant path into Web3 data distribution.

A hedge fund can publish its own quotes, earn network fees, and still protect proprietary flow which can turn a cost center into a revenue stream.

🌎 For Everyone Else: It’s transparency on tap: you can verify exactly where each data point came from. No NDAs, no gatekeepers.

“Finance runs on data the way engines run on oil. Pyth refines it for a new machine.”

The People and Pedigree Behind Pyth

The network’s credibility rests on serious engineering DNA.

Incubated by Jump Crypto: one of the largest quant trading firms globally, giving Pyth instant legitimacy with data contributors.

Core development via Douro Labs: a spin-out focused on Pyth’s architecture and community.

Pyth Data Association (Switzerland): oversees standards, grants, and ecosystem growth.

Dozens of publishers (ranging from Cboe Digital to Virtu, Binance, OKX, and Wintermute) now feed live data.

Few oracles can claim that kind of institutional roster.

📍 The Bottom Line

Pyth wants to rebuild how the world’s price data moves, direct from trading firms and exchanges, on-chain, and open to everyone.

Pyth Network is making a massive bet: that the future of finance depends on trusting data you can verify, not just buy.

Check out Pyth below: