- Crypto Sum

- Posts

- Tether Goes All-In on Gold

Tether Goes All-In on Gold

Tether shakes up gold market with massive metal hoard

Good Morning,

Here's a quick preview of today’s content: Viral AI ‘Clawdbot’ risks leaking private credentials, Arizona advances bill to exempt crypto from property taxes, 39% of US merchants now accept crypto, Trump family American Bitcoin lifts holdings to 5,900 coins, Morgan Stanley appoints new head of crypto strategy, and so much more

Happy Wednesday - Let’s dive in.

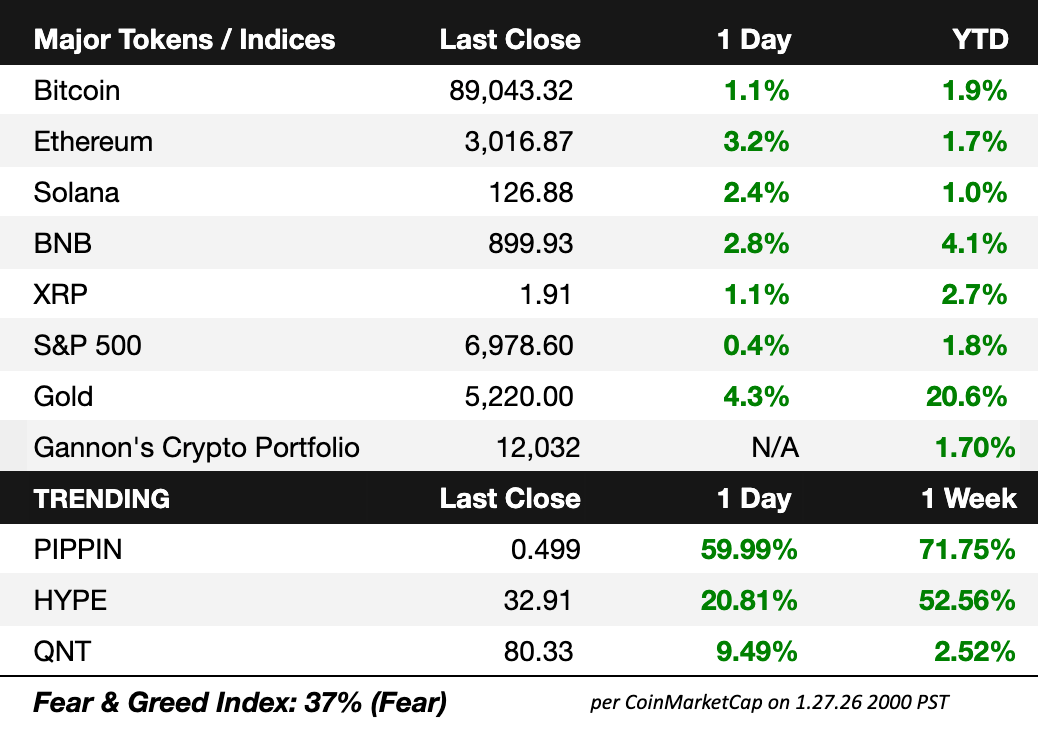

Market Snapshot

Click here to learn more about the Gannon’s portfolios and subscribe to the strategies on Autopilot.* Since inception (7/7/25), Gannon’s Crypto Portfolio is up +20.32%

Crypto steadies as ETF flows flip positive, but metals keep stealing focus

BTC hovered $90K, briefly popping on dollar weakness tied to Trump comments

Spot BTC ETFs turned positive after a five-day, $1.7B outflow streak

ETH supply tightened, with 30% of ETH now staked

Altcoin action was muted: BNB rose +2.5% on utility growth, ZEC jumped +9% on improving privacy-coin sentiment

Market tone remained cautious, with most top-10 assets flat to slightly lower and XRP leading modest losses

Prediction Markets

Bettors on Polymarket are predicting Super Bowl Champion 2026?

Track and trade live odds on any event, only on Polymarket

Headline Roundup

The major headlines driving crypto markets

Tether shakes up gold market with massive metal hoard (BBG)

US Marshals confirm probe into $40M theft of seized crypto (CT)

Trump family American Bitcoin lifts holdings to 5,900 coins (CD)

Report finds stablecoins are $500B risk to bank deposits (BBG)

60% of top US banks are geared up for Bitcoin (CT)

Steak ’n Shake adds $5M Bitcoin exposure (BM)

39% of US merchants now accept crypto (BM)

Morgan Stanley appoints new head of crypto strategy (TB)

Trading 212 let UK retail trade crypto without approval (CT)

Whale wallet moves $397M ETH to Gemini (TB)

Laser Digital seeks US banking charter (TB)

KuCoin taps LSEG exec to lead MiCA expansion (CT)

Ethereum network game shuts down servers (DC)

Nasdaq vet joins Securitize as VP (TB)

Animoca brings DeFi to Japanese institutions (CT)

Wemade taps Chainlink for Korean stablecoin (CT)

WhatsApp lawsuit draws skepticism from cryptographers (DC)

Kalshi opens new DC office (TB)

Korea Digital Asset builds crypto infrastructure (CD)

Nifty Gateway promises permanent NFT hosting (TB)

Venture Capital

Crypto payments startup Mesh raises $75M Series C led by Dragonfly Capital (DC)

Nordic digital bank Lunar raises $55M funding round from Heartland, Orbit Alliance and new investor 100A (TE)

alfred, a payments infrastructure startup, raises $15M Series A led by F-Prime Capital with Brevan Howard Digital and White Star Capital participating (FM)

Tokenized asset startup Tenbin Labs raises $7M led by Galaxy Ventures, joined by Wintermute Ventures, GSR, FalconX and others (CD)

Access the complete VC deal flow on Fundable.

Launches

Regulation

Arizona advances bill to exempt crypto from property taxes (DC)

UK regulator finalizes crypto rules (CT)

South Dakota takes run at Bitcoin reserve bill (CT)

Japan seeks input on bonds eligible for stablecoin reserves (TB)

Senator shelves card fee provision in crypto bill markup (CT)

Australian regulator secures $9.7M penalty over violations (TB)

Cybersecurity

Extra Reads

A year into the second Trump presidency, the SEC has pulled back from major crypto cases and changed its priorities - Here’s how the SEC is handling crypto cases

Data shows February tends to be one of BTC’s best performing months, leading Bitcoin network economist Timothy Peterson to dub it the real “Uptober” event - Here’s why Bitcoin’s ‘Uptober’ moment might start in February

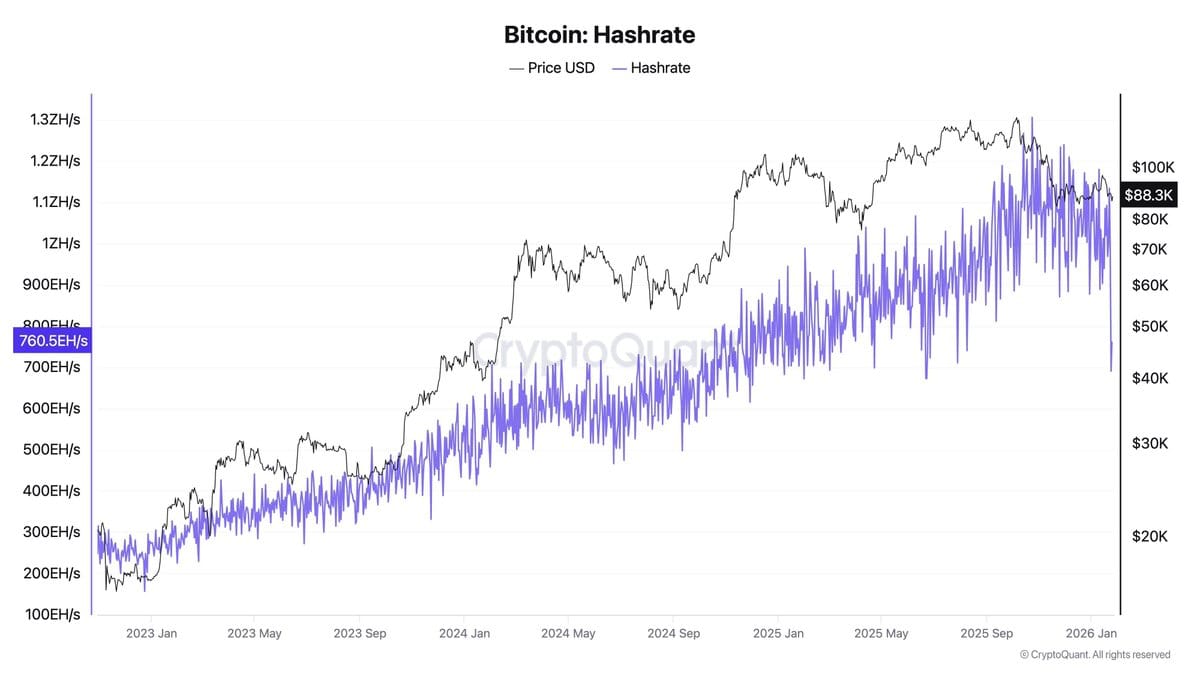

Chart of the Day

Bitcoin hashrate crashes -30% due to winter storms

How was today's newsletter? |

Meme Dump

Pls send us crypto memes to be featured in the newsletter 🤝

🐦 Follow Us: Visit our X account for daily updates on all things web3, DeFi, & crypto.

💰 Gannon’s Crypto Portfolio: Trade alongside Gannon’s crypto on Autopilot

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity’s brain on business advice, insights, or just chat to say what’s up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot advisers LLC, an SEC registered investment advisor. Past performance does not guarantee future results. Investing carries risks including the risk of the loss of principal. Performance doesn’t include fees. See more here.