- Crypto Sum

- Posts

- Gavin Newsom: ‘Trump Corruption Coin’

Gavin Newsom: ‘Trump Corruption Coin’

Trump's World Liberty token falls in first day of trading

Good Morning,

Here's a quick preview of today’s content: Tron dramatically slashes transaction fees, shareholders approve the Trump linked merger, California Governor Gavin Newsom wants to launch his own coin, former cred execs sentenced to federal prison, Argentina’s opposition revives the LIBRA scandal investigation, and so much more

we hope everyone had a relaxing Labor Day weekend with family and friends

this newsletter is jam packed with updates so make sure to read till the end

Grab a cup of coffee, Let’s dive in.

Market Snapshot

Click here to learn more about the Gannon’s portfolios and subscribe to the strategies on Autopilot.*

Bitcoin reclaimed $109,000 Monday morning, after dipping to $107,500 over the weekend

Ethereum has sagged -1.5% on the day to $4,406 amid a broader -4.3% weekly drop as recent PCE data caused prices to slump over the weekend

Despite this, Ethereum dominated institutional crypto inflows, accounting for 57% of the $2.48B that the market attracted

Ethereum has gained +17% over the past month while Bitcoin slipped -5.5%

Crypto prices dropped on hot inflation data, with stocks also dipping on Friday as the market rolls into Red September

Market Predictions

Headline Roundup

The major headlines driving crypto markets

President Trump-backed World Liberty Financial debuts its Ethereum token for trading on Monday at $7.6B market cap (DC)

Crypto internet sleuth ZachXBT exposes the price sheet of 200+ crypto influencers and their wallet addresses from a project they were recently contacted by to promote (X)

Trump's World Liberty token falls in first day of trading (RT)

Consensys founder Joseph Lubin says Wall Street adoption of Ethereum will see ETH surge by 100 times and flip Bitcoin (CT)

Businesses are absorbing Bitcoin 4x faster than it is mined (CT)

Stablecoins could trigger taxpayer bailouts, warns Nobel economics laureate (FT)

President Trump and his family’s net worth surges by almost $6B after trading begins for WLFI (DC)

A growing number of private jet and ultra-luxury cruise operators are taking cryptocurrency payments amid booming demand from travellers (FT)

Crypto treasury firms pose similar risks as CDOs and other types of debt that triggered the 2007-2008 financial crisis (CT)

Binance founder CZ says public-company Bitcoin treasuries and ETFs are “fantastic” for crypto (CD)

Crypto borrowing explodes to a record $44.25B in Q2 (CS)

Bitcoin ETFs now drive up to $10B in daily trades (CT)

South Korea’s FSC chief nominee Lee Eok-won says crypto has no intrinsic value (TB)

El Salvador’s National Bitcoin Office split its BTC holdings between 14 addresses (TB)

A Bitcoin whale buys $2.5B worth of Ethereum after seven years of dormancy (TB)

Ethereum on-chain volume surpasses $320B during August (TB)

Elon Musk’s lawyer Alex Shapiro is listed as chairman for a Dogecoin DAT (TB)

Eric Trump says that there is “no question” that BTC hits $1M in the next several years (CT)

RAK Properties, a real estate company in the UAE, will start accepting crypto for international property transactions (CT)

Pete Davidson and Casey Affleck will star in ‘Killing Satoshi,’ a high-stakes Bitcoin conspiracy thriller (TB)

Japan Post Bank to let customers convert savings into tokenized deposits on a permissioned blockchain (TB)

Ethena’s USDe stablecoin surges to $12B supply (TB)

More than 90 applications for crypto ETFs waiting SEC approval (DC)

Global crypto investment products register net inflows of $2.48B last week (TB)

Estimates show BTC ownership at 65.9% for individuals (CD)

DEXs record $1.1T in trading volume in August (CS)

Solv Protocol partners with Chainlink to integrate verification of BTC reserves into its SolvBTC price feed (CD)

21Shares files with the SEC for the first SEI ETF (DC)

Eric Trump praises China for its significant influence on Bitcoin and crypto (CD)

Metaplanet purchases 1,009 BTC, worth around $112B (TB)

Cluster of asset managers update their filings for a spot Solana ETF (TB)

Binance appoints SB Seker, formerly senior vice president at Crypto.com, as its new head of APAC (TB)

Jupiter Lend, a lending protocol, surpasses $500M in TVL as on-chain lending hits ATH (TD)

The Bank of China’s Hong Kong branch stock shoots up by 6.7% on reports that it plans to apply for a stablecoin issuer license (DC)

The Trump administration looks at a postwar plan for Gaza using tokenized land and crypto to relocate and rehouse residents (CT)

Strategy officially qualifies for potential inclusion in the S&P 500 (CD)

The Ethereum Foundation is pausing its open grants programs as it looks to redirect funding (TB)

Amplify Investments files a prospectus for an XRP monthly option income ETF with the SEC (TB)

Tron is slashing transaction fees by 60% (CS)

China’s CNPC starts feasibility study on stablecoins for cross-border payments (TD)

European crypto asset manager CoinShares posts $32.4M in Q2 net profit (TB)

Hong Kong crypto exchange OSL posts $25.1M in total revenue in the first half of this year (TB)

Prediction market protocol Myriad passes $10M in USDC trading volume (DC)

Robinhood adds TON to its U.S. crypto trading platform (TD)

Nike Inc. and StockX settle a three-year case over sneaker-linked NFTs (DC)

Real Vision CEO Raoul Pal predicts total number of crypto users could hit 4B by 2030 (CT)

Tokyo-based game developer Gumi Inc. to acquire $17M worth of XRP (CS)

Venture Capital

AMBTS raises $23.2M in its initial financing round from Amdax (CD)

aPriori, a crypto startup building an execution layer for on-chain markets, raised a $20M round from HashKey Capital, Pantera Capital, Primitive Ventures, and more (CD)

FinChain, a Web3 brand incubated by Fosun Wealth Holdings, raised a multi-million dollar round from Solana Foundation, Vaulta Foundation, Sonic Labs, Animoca Brands, and more (PRN)

Portal, a Bitcoin-first protocol enabling trust-minimized cross-chain trading, raised $50M led by Paloma Investments (CD)

Stablecoin startup Mo raised a $40M Series B led by Polychain and Ribbit Capital (CD)

Stablecoin fintech Rain raised a $58M Series B led by Sapphire Ventures (CB)

Crypto fundraising surges past $16B this year (BW)

Chinese developer Seazen plans to issue tokenized private debt this year (BBG)

Web3 startups raise $9.6B across 306 deals in the second quarter (CD)

Metaplanet shareholders approve an $884M capital fundraising plan (DC)

Crypto executives to raise $200M via a SPAC (CT)

Canadian firm Luxxfolio files a shelf prospectus to raise $73M (DC)

M&A Announcements

Launches

DeFi Development Corp. launches an extension of its crypto treasury firm into the UK (TB)

Binance launches Medá in Mexico, a regional crypto hub (CT)

InFocus unveils ‘InFocus Digital Ventures’, a new blockchain, AI, and Bitcoin-focused unit (CD)

NFT brand Pudgy Penguins launches a web3 mobile title called 'Pudgy Party'(TB)

Sonic Labs given the nod to issue $200M worth of its S tokens to expand into the U.S. capital markets (CT)

Bitcoin-Safe launches a hardware-focused multisig wallet (BM)

Coinbase and OKX introduce SMSFs in Australia (CT)

Regulation

Cybersecurity

U.S. banks are responsible for moving $312B for Chinese money launderers between 2020 and 2024 (CT)

A hacking syndicate stole $28.1M from financial and crypto accounts of wealthy Koreans (DC)

14 individuals jailed after orchestrating a Bitcoin extortion plot in India (TB)

Bitcoin home invasion ringleader gets more prison time for beating witness (DC)

Crypto investment platform Unicoin urges judge to toss SEC’s $100M fraud case (CT)

Strategy investors decide to drop class action alleging Bitcoin treasury company misled them (TB)

Former cred execs sentenced to federal prison for $150M crypto fraud (DC)

Dutch and U.S. authorities shut down VerifTools, a crypto-fueled fake ID marketplace (DC)

Argentina’s opposition revives the LIBRA scandal investigation into President Javier Milei (CS)

Scammers exploit Discord communities leading to significant crypto and NFT thefts (CT)

Extra Reads

Gold still protects against stock sell-offs while Bitcoin hedges bond stress, raising questions about their roles in portfolios - Bitcoin or Gold: Which Is the Better Hedging Asset in 2025?

As Congress struggles to work out a crypto tax approach in the U.S., the experts at the IRS are heading for the exits - State of Crypto: Unsettled U.S. Crypto Tax Scene

Chart of the Day

ETH is having its best Q3 ever

How was today's newsletter? |

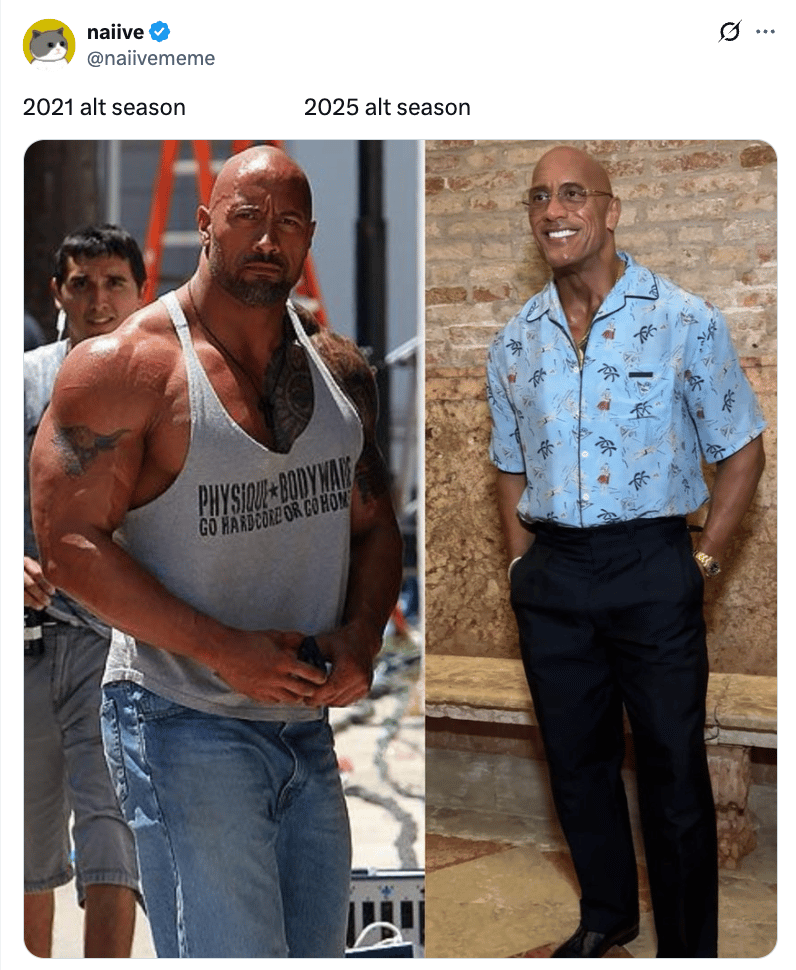

Meme Dump

Pls send us crypto memes to be featured in the newsletter 🤝

🐦 Follow Us: Visit our X account for daily updates on all things web3, DeFi, & crypto.

💰 Gannon’s Crypto Portfolio: Trade alongside Gannon’s crypto on Autopilot

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity’s brain on business advice, insights, or just chat to say what’s up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot advisers LLC, an SEC registered investment advisor. Past performance does not guarantee future results. Investing carries risks including the risk of the loss of principal. Performance doesn’t include fees. See more here.