- Crypto Sum

- Posts

- Dalio Admits BTC Stake

Dalio Admits BTC Stake

Ray Dalio owns “small percentage” of Bitcoin

Good Morning,

Here's a quick preview of today’s content: British fraud office arrests two men accused of rug pull, Rep. Davidson introduces bill to allow taxes be paid in BTC, 21Shares adds 2x leveraged DOGE ETF, 1 in 3 young investors switched advisers over crypto access, Andrew Tate loses everything on Hyperliquid, and so much more

Friday’s here - Let’s dive in.

Market Snapshot

Click here to learn more about the Gannon’s portfolios and subscribe to the strategies on Autopilot.* Since inception (7/7/25), Gannon’s Crypto Portfolio is up +21.29%

Bitcoin and Ethereum slid sharply as fading hopes for another Fed rate cut fueled nearly $1B in liquidations

Bitcoin spot ETFs saw $75M in inflows, snapping a five-day streak that saw $2.26B leave, as BTC slides -31% from last month’s record high

XRP and other majors remained deep in the red amid broad risk-off pressure

Whale activity is on pace for its largest week of 2025, even as Bitcoin crashed to $86,000

The sell-off has been led by mid-cycle wallets, while long-term whales continue holding steady

Headline Roundup

The major headlines driving crypto markets

Billionaire dumps entire $1.3B BTC stash after 14 years (DC)

Andrew Tate loses everything on Hyperliquid (CS)

Ray Dalio owns “small percentage” of Bitcoin (DC)

Grok says Elon is the most intelligent person alive (DC)

JPMorgan says Strategy could face billions in outflows (TB)

Argentina's Milei provides collaboration for Libra project (TB)

Metaplanet plans $95M BTC purchase (TB)

Tether’s gold hoard surges to 116 Tons (CD)

Solana ETFs post second-biggest November inflows (CD)

Ark Invest buys more Circle, Bullish and BitMine (TB)

DeFi lending hits new record in Q3 (TD)

1 in 3 young investors switched advisers over crypto access (CT)

61% of retail investors in Singapore hold crypto (FM)

Digital gold wave sees Swiss trader reviving token (BBG)

Bitcoin Core's first audit finds no major vulnerabilities (TB)

FG Nexus latest Ethereum treasury to sell ETH (DC)

WLFI’s image strained as project freezes wallets (CT)

Poll shows young conservatives willing to give AI control over policy (DC)

BitMine sits on $3.7B paper loss (CT)

Core Foundation secures injunction against Maple over BTC product (DC)

Ripple weighs staking overhaul to expand XRP (DC)

Crypto exchange Ripio reveals $100M treasury (CD)

Securitize leverages Plume to expand RWA reach (CD)

VerifiedX taps Crypto.com for custody and liquidity (CD)

Dinari integrates LayerZero offering tokenized equities access (TD)

S&P gives Justin Sun-linked TrueUSD lowest score (TD)

Cipher Mining inks HPC deal with Fluidstack (TB)

Record Financial pushes royalties on Avalanche (DC)

AVAX approves $40M stock buyback (CD)

MEXC taps Hacken for proof-of-reserves audits (CT)

TokaCity partners with SACHI for Web3 gaming (CD)

Logos unifies under one identity to deliver private tech stack (CD)

Venture Capital

Polymarket seeks to raise additional funds at $12B valuation (TD)

Kalshi raises $1B in a new funding round at an $11B valuation (CD)

Metaplanet to raise $135M through issuance of Class B perpetual preferred shares (CT)

AI hedge fund Numerai raises $30M Series C led by top university endowments (CD)

Layer-1 blockchain CratD2C raises $30M strategic investment led by Nimbus Capital (PS)

Build on Bitcoin, a DeFi infrastructure startup, closes an undisclosed community sale that lifts its total funding over $25M (CP)

Tether invests in crypto infrastructure firm Parfin to grow adoption of stablecoins in Latin America (CD)

Launches

Coinbase adds ETH-backed loans via Morpho (TB)

Bitwise spot XRP ETF launches (TB)

21Shares adds 2x leveraged DOGE ETF (DC)

India's debt-backed ARC token eyes 2026 debut (CD)

Metaplanet offers dividend-paying preferred shares (DC)

Aave and Chainlink ETPs among six new listings in Europe (CT)

MegaETH opens pre-deposit window for stablecoin (TB)

World App starts accounts pilot for USDC payroll deposits (CD)

Securitize launches assets on Plume’s protocol (TD)

Aztec launches privacy-focused L2 on mainnet (TB)

Sequence unveils transaction platform Trails (DC)

TokenWorks opens strategy deployments (BL)

Regulation

Rep. Davidson introduces bill to allow taxes be paid in BTC (TB)

Lawmakers clear Trump pick Michael Selig to lead the CFTC (TB)

Crypto coalition calls Trump to expedite regulatory guidance (TB)

India’s government considers stablecoin framework (CT)

Brazil considers taxing international crypto payments (CD)

SEC to hold privacy and financial surveillance roundtable in December (CT)

Trump eyes executive order for AI policies (DC)

Advocacy groups urge Trump to intervene in the Roman Storm retrial (CT)

Ex-prosecutor denies promising not to charge FTX partner (CT)

Cybersecurity

Extra Reads

Bitcoin enters bearish territory as institutional buying wanes and key indicators turn negative, signaling a potential end to the current market cycle - Is the bull cycle ending?

Ether treasury companies are holding millions of dollars in unrealized losses, and the falling mNAV valuations and ETH’s potential to fall below $2,500 may further complicate matters - Here’s why ETH DATs have a problem

Chart of the Day

Bitcoin makes up 54% of collateral, but altcoins are quietly climbing to 32%

How was today's newsletter? |

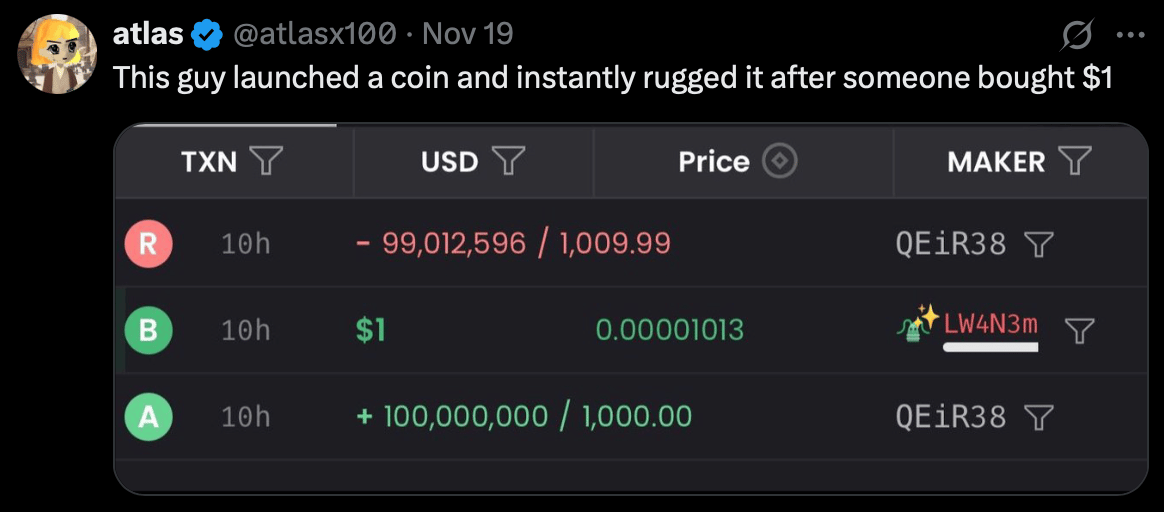

Meme Dump

Pls send us crypto memes to be featured in the newsletter 🤝

🐦 Follow Us: Visit our X account for daily updates on all things web3, DeFi, & crypto.

💰 Gannon’s Crypto Portfolio: Trade alongside Gannon’s crypto on Autopilot

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity’s brain on business advice, insights, or just chat to say what’s up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot advisers LLC, an SEC registered investment advisor. Past performance does not guarantee future results. Investing carries risks including the risk of the loss of principal. Performance doesn’t include fees. See more here.