- Crypto Sum

- Posts

- Crypto Bill Turnaround

Crypto Bill Turnaround

Thirteen Republicans voted against a key rule Tuesday but Trump got them back into the room

Good Morning,

Here's a quick preview of today’s content: Thirteen Republicans voted against a key rule Tuesday but Trump got them back into the room, Cantor is on its big move, James Wynn continues to hit home runs after several strikes, Citigroup to launch its own stablecoin, token trading is running into trouble, crypto ‘Godfather' corruption case takes another turn, and so much more.

Happy Wednesday - Let’s dive in.

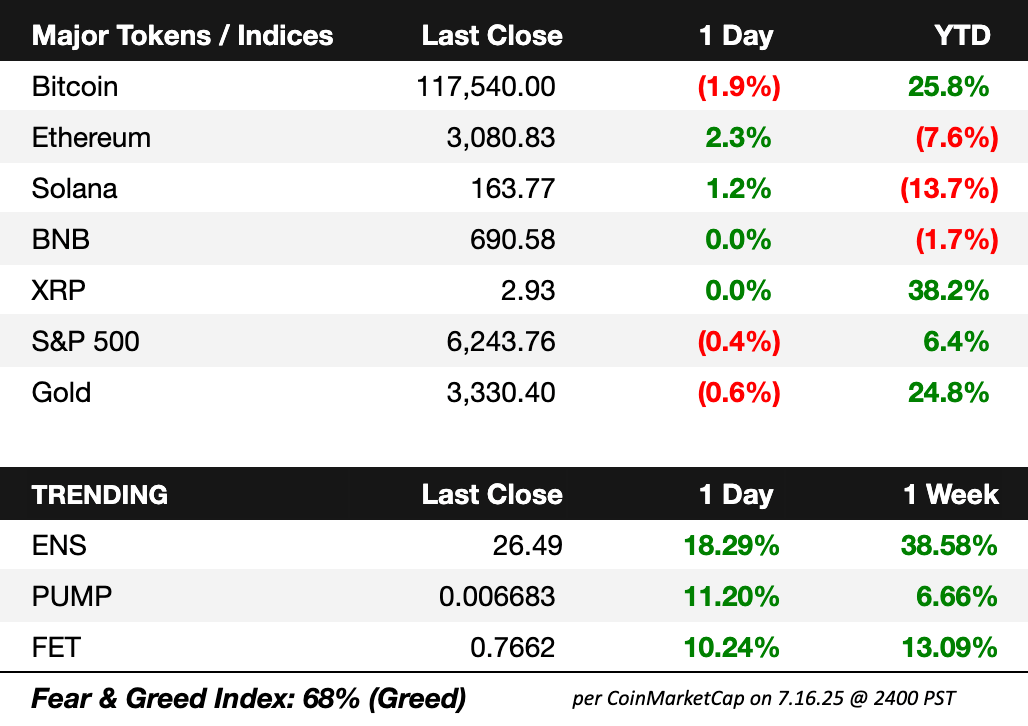

Market Snapshot

Bitcoin held near $118,000 as U.S. CPI data suggested further disinflation, raising hopes for a September Fed rate cut

Core CPI rose just 0.1% month-over-month for the fifth straight time

Institutional interest in cryptocurrencies remains strong, with significant inflows into U.S. spot bitcoin and ether ETFs

Despite broader equity market weakness, crypto markets showed resilience, buoyed by positive sentiment and legislative developments

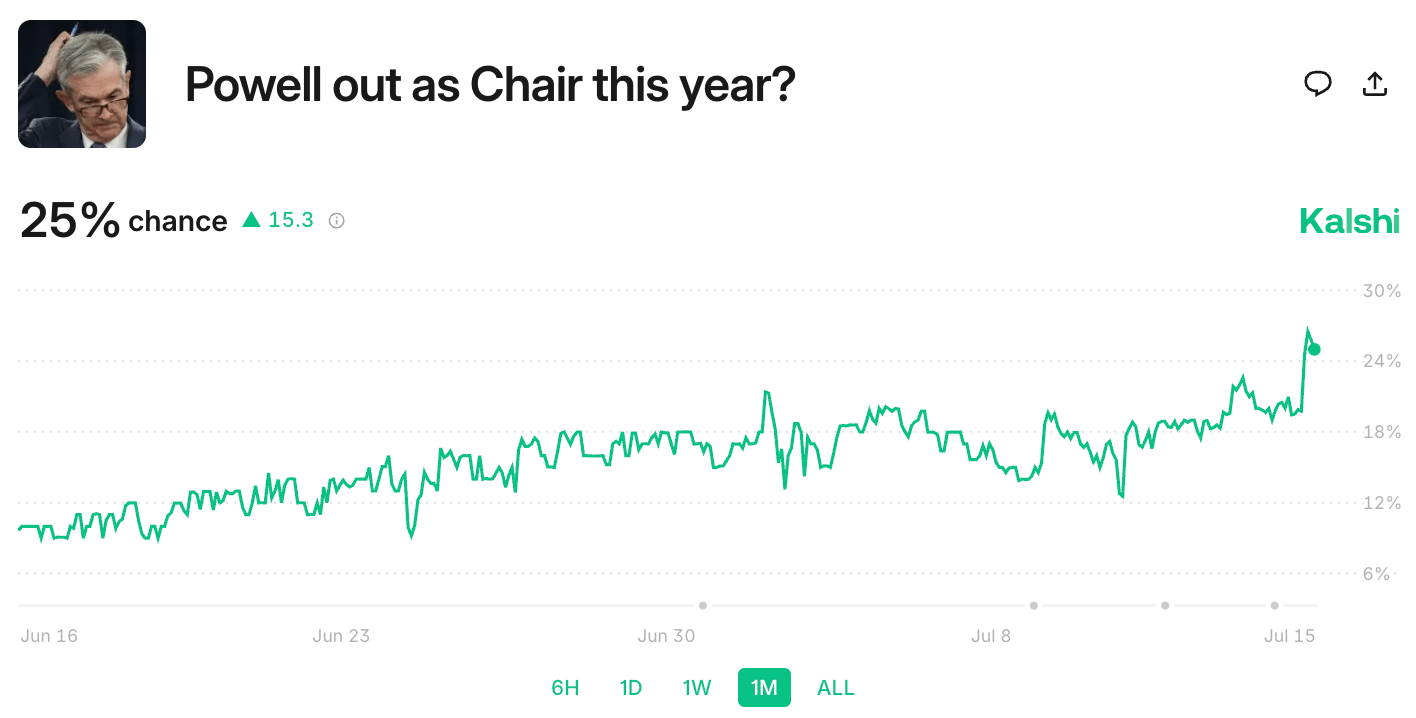

Market Predictions

Headline Roundup

The major headlines driving crypto markets

President Trump rallied House Republicans back into line Tuesday night after a procedural revolt nearly derailed major crypto bills - the entire crypto congress saga here

Cantor Equity Partners 1 is nearing a deal with Adam Back, founder of crypto trading group Blockstream Capital, to buy ~$4B in Bitcoin with backing from Cantor Fitzgerald and external investors (FT)

Fidelity subsidiary becomes largest shareholder of bitcoin treasury firm Metaplanet (TB)

Legendary trader James Wynn turns $100K into $19M betting on Bitcoin and Pepe (CT)

Token trading runs into trouble (WSJ)

Deutsche Bank says Bitcoin is experiencing a historic drop in volatility levels (BM)

New Zealand police investigate brutal murder tied to crypto dealings (TB)

Coinbase hits record high as analysts highlight strong Bitcoin-driven growth (DE)

GameStop CEO Ryan Cohen unveils Bitcoin treasury strategy and teases crypto payment plans (DE)

Citigroup is looking to issue its own stablecoin to smooth payments (BBG)

Wintermute says institutions are accumulating Bitcoin and Ethereum while retail cools off (DE)

Sharplink adds $225M in Ethereum, becoming a leading ETH treasury holder (DE)

ProShares wins NYSE Arca approval for 2x leveraged XRP ETF (TD)

Kraken sees 29% market share as new products drive rapid expansion (TB)

Solana RWA growth in 2025 outpaces Ethereum across major adoption metrics (TD)

Polymarket DOJ probe dropped under Trump (BB)

Bitcoin Mempool activity drops, raising concerns over network fee security (TD)

NYSE’s Uniswap President Mary-Catherine Lader steps down amid strategic shift (CT)

LQwD increases BTC holdings to 238.5 and reports 54.6 BTC yield YTD (BM)

Sheriff’s deputy charged, another pleads guilty in crypto “Godfather” corruption case (DE)

South Korea crypto PAC Fairshake builds $141M election war chest ahead of 2026 vote (TB)

Bitcoin chases American dream in norm-shattering mortgage push (BBG)

Venture Capital

M&A Announcements

The Blockchain Group raises €6M and boosts Bitcoin treasury with new purchases (BM)

Launches

Kraken launches unified access to crypto derivatives alongside NinjaTrader platform (CT)

Standard Chartered begins spot Bitcoin and Ethereum trading for institutional clients (TD)

TAC mainnet goes live, bridging Ethereum with TON ecosystem (BW)

BNB Chain to launch Ondo Finance’s suite of tokenized U.S. stocks (TD)

Roxom to launch Bitcoin-denominated capital markets platform this September (BM)

Regulation

U.S. House panel declares digital assets a national priority in landmark resolution (TD)

Cybersecurity

Extra Reads

This week, Cantor Fitzgerald advanced what may become one of the largest Bitcoin treasury moves to date - Inside Cantor Fitzgerald’s $4B Bitcoin Treasury Deal with Blockstream

How was today's newsletter? |

Meme Dump

Pls send us crypto memes to be featured in the newsletter 🤝

🐦 Follow Us: Visit our X account for daily updates on all things web3, DeFi, & crypto.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity’s brain on business advice, insights, or just chat to say what’s up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.