- Crypto Sum

- Posts

- Coinbase Pulls the Plug

Coinbase Pulls the Plug

Coinbase pulls support for crypto market structure bill

Together with

Good Morning,

Here's a quick preview of today’s content: Crypto bill nears crunch time as amendments pile up, AI drives crypto scam losses to $17B, JPMorgan expects crypto inflows to rise further in 2026, More than half of crypto tokens failed in 2025, Eric Adams says he did not profit from memecoin, and so much more

Make sure to check out our sponsor Oceans - to find top talent at lower costs and no Headaches

Happy Thursday - Let’s dive in.

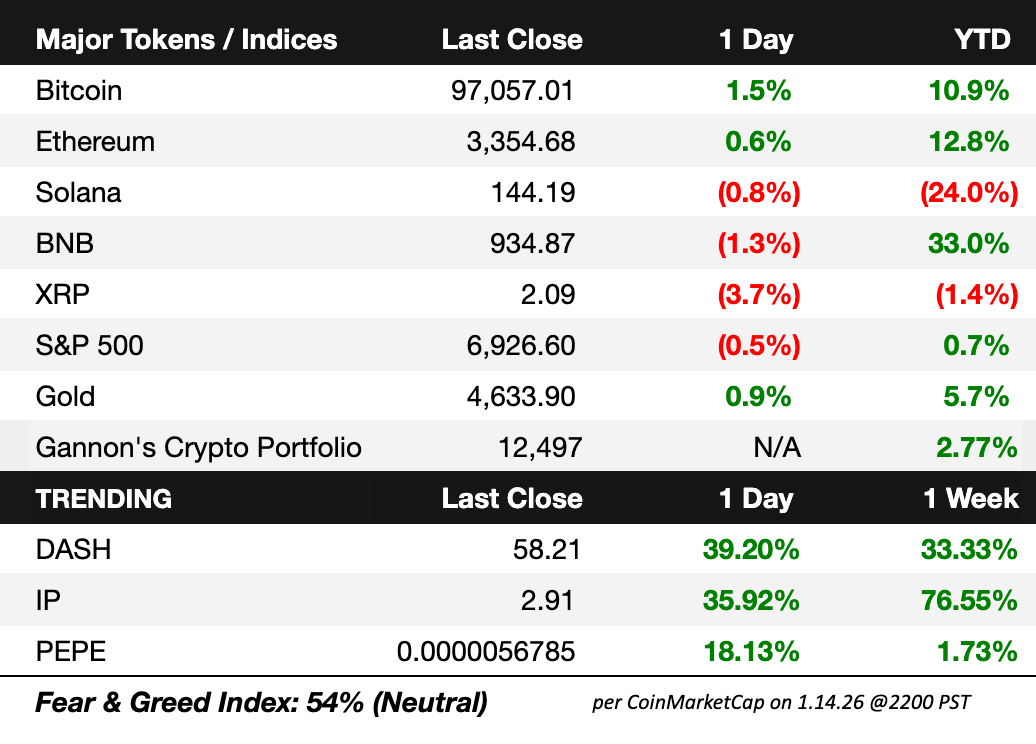

Market Snapshot

Click here to learn more about the Gannon’s portfolios and subscribe to the strategies on Autopilot.* Since inception (7/7/25), Gannon’s Crypto Portfolio is up +24.97%

Bitcoin rips toward $100K as ETF inflows and short liquidations fuel breakout

BTC tagged $97K (+4.4%), hitting a 2026 high as nearly $800M in short positions were liquidated

Spot BTC ETFs pulled in $750M, the strongest single-day inflow in three months

Altcoins joined the breakout: ETH, SOL, and ADA jumped +8%, DOGE gained +9%, and XRP rose +6% on higher volumes

Ethereum staking hit a record, with 30% of ETH supply locked

The rally lifted total crypto mcap to $3.38T (+3.4%)

Prediction Markets

Bettors on Polymarket are predicting record crypto liquidation in 2026?

Track and trade live odds on any event, only on Polymarket

Headline Roundup

The major headlines driving crypto markets

Coinbase pulls support for crypto market structure bill (DC)

Eric Adams says he did not profit from memecoin (BBG)

Sen Lummis says crypto bill hearing may get postponed (CD)

JPMorgan expects crypto inflows to rise further in 2026 (TB)

Advocates press lawmakers on stablecoin tax rules (DC)

Pakistan explores stablecoin remittances via World Liberty Financial (DC)

Visa partners with BVNK to enable stablecoin payouts (DC)

More than half of crypto tokens failed in 2025 (CD)

Prediction market volume hits record $702M (CT)

Bitcoin and gold allocation outperforms traditional portfolios (TB)

EU exchange Bitpanda eyes $5B IPO (DC)

SEC concludes Zcash investigation with no charges (DC)

Galaxy says crypto bill risks expanding surveillance authority (CT)

South Korean KB files patent for stablecoin credit card (TB)

North America becomes less dominant in Bitcoin mining (DC)

CleanSpark expands AI power capacity in Texas (CD)

Algorand returns to US amid friendlier crypto regulation (CD)

BitMine’s staked Ether reaches 1.5M (CT)

Ripple secures key European license (DC)

MANTRA cuts staff amid restructuring (TB)

A Message From Oceans

In crypto, speed is everything. Compliance, data, and reporting can’t lag behind.

Oceans helps fintech and digital-asset companies scale smarter with vetted offshore talent in finance ops, compliance, and analytics.

Our professionals have worked with global exchanges, Web3 startups, and DeFi platforms — supporting token accounting, audit readiness, and financial reporting that keeps pace with innovation.

Build a lean, round-the-clock finance backbone so your core team can focus on product and growth.

Same U.S. caliber skill sets. Up to 80% cost savings.

While competitors hesitate, your team can already be executing.

Hire smarter. Scale faster.

Venture Capital

Brokerage-infrastructure startup Alpaca raises $150M Series D led by Drive Capital at $1.15B valuation, joined by Citadel Securities and others (BW)

Project Eleven raises $20M Series A at $120M valuation led by Castle Island Ventures (TB)

VelaFi, a stablecoin infrastructure startup, raises $20M Series B led by XVC and Ikuyo (BW)

GooMoney, an on-chain treasury protocol, secures strategic commitments totaling $19.3M (CD)

RWA vault startup KAIO raises $11M seed round from Laser Digital, Brevan Howard, and Karatage (X)

Crypto VC firm Paradigm leads $7.1M seed investment into Noise, a startup building a predictions market (TB)

Web3 AI platform Neuramint raises $5M seed round led by Maelstrom with participation from Borderless Capital, Selini Capital, and more (PRN)

Access the complete VC deal flow on Fundable.

M&A Announcements

Launches

Bitwise launches Chainlink ETF on NYSE (DC)

Ledger Wallet rolls out 'BTC yield' feature (TB)

World Liberty Financial stablecoin lands on Myriad (DC)

Binance Wallet unlocks leveraged crypto futures trading (CD)

Figure unveils onchain equity network (TB)

Bitnomial launches regulated Aptos futures (TB)

Backpack launches closed-beta prediction markets (TB)

Bybit Pay offers crypto payments in Peru (CD)

PrimeXBT expands crypto futures with new assets (CD)

Mobile wallet Oobit adds Phantom support (TB)

Berachain unveils ‘Bera Builds Businesses’ plan (TD)

Fondeo.xyz introduces 24 hour payout guarantee (CD)

Regulation

Crypto bill nears crunch time as amendments pile up (TB)

Russia finalizes bill to open crypto market (TB)

Rhode Island reintroduces Bitcoin tax exemption bill (BM)

Germany’s DZ Bank secures crypto trading license (CD)

France flags 90 unlicensed crypto companies (CT)

Crossmint gets MiCA nod for stablecoin infrastructure (CT)

UK rolls back digital ID for work checks (CT)

Cybersecurity

Extra Reads

Ethereum could narrow its performance gap with Bitcoin in 2026 as capital rotates and on-chain activity improves - Here’s why Ethereum could outperform Bitcoin

Banks argue that stablecoin rewards offered through exchanges exploit a GENIUS Act loophole, blurring the line between payment tokens and savings accounts - Here’s why banks say the GENIUS Act has a stablecoin loophole

Chart of the Day

Over 11.6M crypto tokens (mainly meme coins) failed in 2025

How was today's newsletter? |

Meme Dump

Pls send us crypto memes to be featured in the newsletter 🤝

🐦 Follow Us: Visit our X account for daily updates on all things web3, DeFi, & crypto.

💰 Gannon’s Crypto Portfolio: Trade alongside Gannon’s crypto on Autopilot

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity’s brain on business advice, insights, or just chat to say what’s up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot advisers LLC, an SEC registered investment advisor. Past performance does not guarantee future results. Investing carries risks including the risk of the loss of principal. Performance doesn’t include fees. See more here.