- Crypto Sum

- Posts

- CME Eyes Own Coin

CME Eyes Own Coin

CME Group explores launching its own coin

Good Morning,

Here's a quick preview of today’s content: Dark web crypto drug market operator sentenced to 30 years, Bessent grilled over Trump-linked World Liberty Financial, Losses top $17B at crypto treasury companies, Wealthy investors see IPO hype waning in 2026, UBS details crypto plans following report of trading, and so much more

Happy Thursday - Let’s dive in.

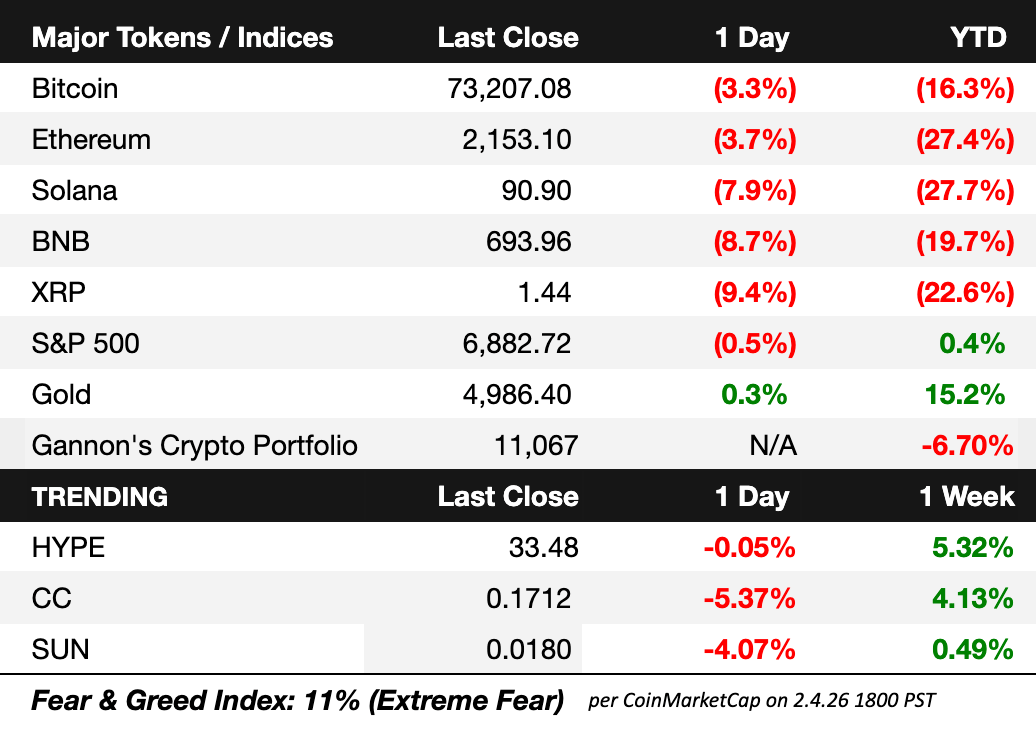

Market Snapshot

Click here to learn more about the Gannon’s portfolios and subscribe to the strategies on Autopilot.* Since inception (7/7/25), Gannon’s Crypto Portfolio is up +47.43%

Bitcoin-led crypto rout erases nearly $500B in market cap as BTC crashes -20% in a week to 15-month lows

BTC falls below $72,000, testing pre-election floor and triggering $800M in liquidations

ETH and XRP funds quietly attract inflows despite Bitcoin's crisis of faith

Growing correlation with troubled software stocks amplifies downside as AI jitters shake tech sector

Crypto steadies after brutal selloff, though analysts warn the bounce may not last

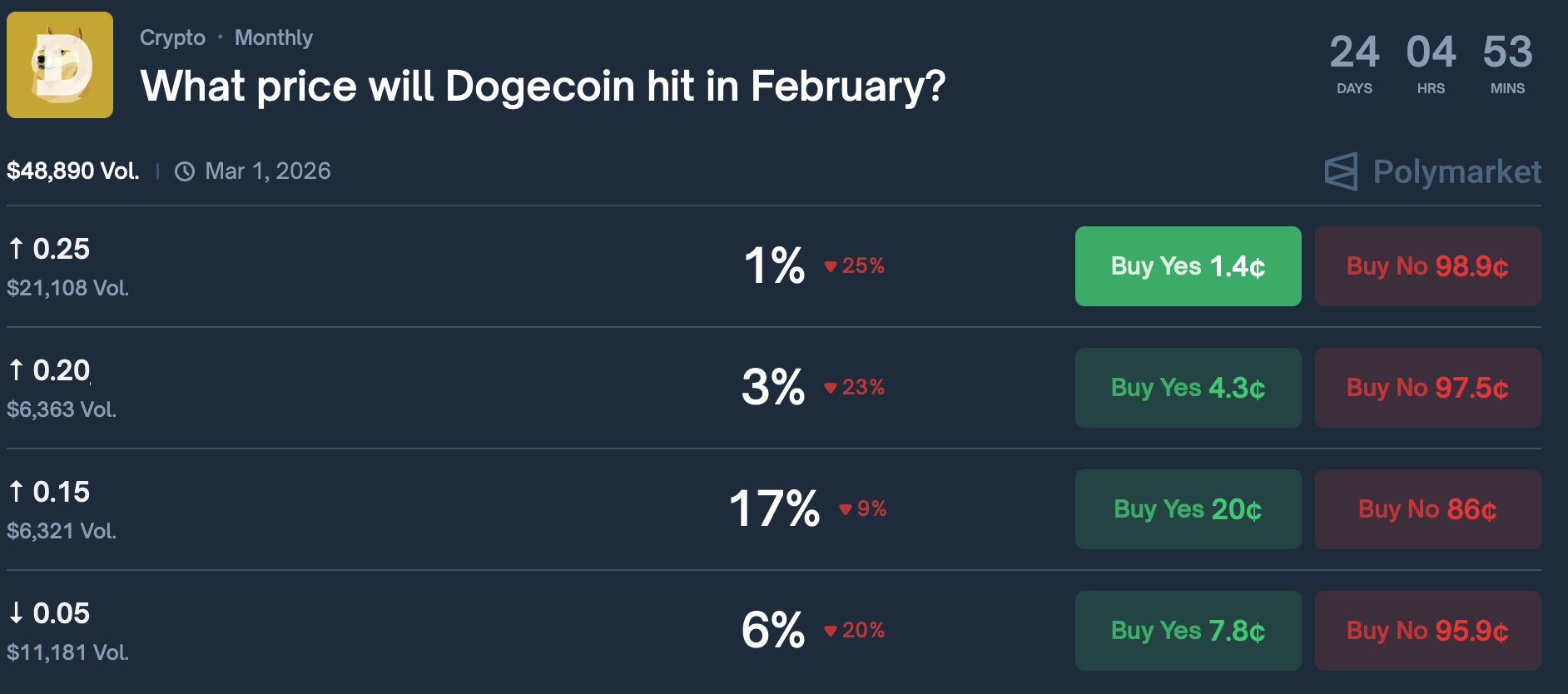

Prediction Markets

Bettors on Polymarket are predicting what price will DOGE hit in February?

Track and trade live odds on any event, only on Polymarket

Headline Roundup

The major headlines driving crypto markets

CME Group explores launching its own coin (DC)

Secretary Bessent says US won't 'bail out' Bitcoin (CT)

Bitcoin dev calls Adam Back to resign after Epstein files revelations (DC)

Crypto floats new compromises in bid to save contentious bill (BBG)

UBS details crypto plans following report of trading (DC)

Anthropic trolls ChatGPT in Super Bowl ad (DC)

Tether scales back $20B funding push (DC)

Binance reserves steady as ‘FTX 2.0’ claims spread online (CT)

Losses top $17B at crypto treasury companies (TD)

Ark Invest goes on $19M buying spree (CD)

Multicoin founder Kyle Samani steps back from investment firm (TB)

Cipher's AI subsidiary holds $2B junk bond sale (TB)

Wealthy investors see IPO hype waning in 2026 (CD)

Vitalik Buterin calls for inclusion of prediction markets (DC)

Polymarket and Kalshi clash over groceries (CT)

BBVA joins EU banks' stablecoin venture (CD)

Hyperliquid treasury seeks revenue boost (TB)

Survey finds crypto investors prioritize infrastructure over DeFi (CT)

Ripple adds Hyperliquid to its brokerage platform (DC)

Indian investors are buying the bitcoin price dip (CD)

Fireblocks integrates Stacks for Bitcoin DeFi (CT)

New Ethereum gaming token airdropped to stakers (DC)

Venture Capital

Tianrui Xiang raises $1.5B strategic financing, featuring 15,000 BTC for equity, led by prominent crypto investor (PM)

Blockchain firm TRM Labs raises $70M Series C round led by Blockchain Capital with participation from Goldman Sachs, Citi Ventures and more (CD)

Blockchain prediction-market platform Opinion raises $20M pre-Series A funding backed by Hack VC and Jump Crypto (CD)

Prediction market startup Kairos raises $2.5M seed round led by Andreessen Horowitz, with participation from Geneva Trading, the University of Illinois, and several angel investors (EGW)

Access the complete VC deal flow on Fundable.

M&A Announcements

Crypto asset manager Bitwise acquires institutional staking services provider Chorus One (TB)

Launches

Regulation

Cybersecurity

Extra Reads

Dubai’s ban on privacy coins highlights how regulators are prioritizing transparency over anonymity in institutional crypto and regulated exchanges - Here’s what Dubai’s ban on Zcash signals for crypto

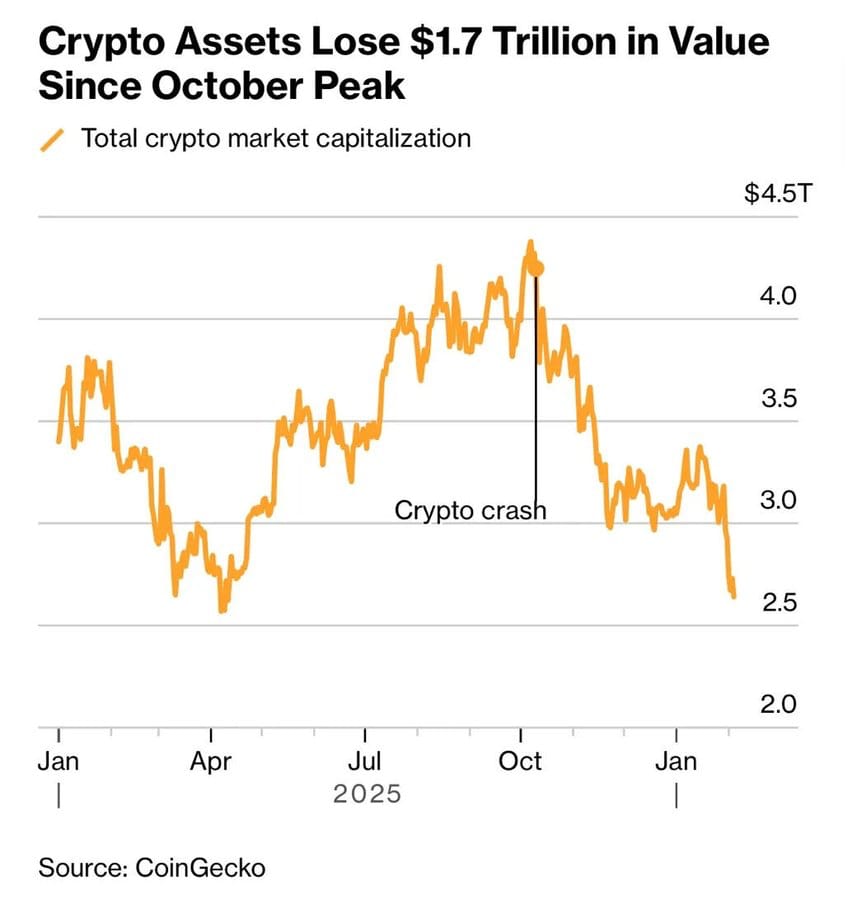

Chart of the Day

Crypto market cap erases nearly $500B in less than a week

How was today's newsletter? |

Meme Dump

Pls send us crypto memes to be featured in the newsletter 🤝

🐦 Follow Us: Visit our X account for daily updates on all things web3, DeFi, & crypto.

💰 Gannon’s Crypto Portfolio: Trade alongside Gannon’s crypto on Autopilot

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity’s brain on business advice, insights, or just chat to say what’s up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot advisers LLC, an SEC registered investment advisor. Past performance does not guarantee future results. Investing carries risks including the risk of the loss of principal. Performance doesn’t include fees. See more here.